Objective: Students will complete their Good Ol’ Days Projects today by presenting their timelines and skits.

Objective: Students will complete their Good Ol’ Days Projects today by presenting their timelines and skits.

Objective: Students demonstrate what they know about Monetary and Fiscal Policy by taking Quiz 6D. Students will work in their Project Teams

You will have two attempts to take this quiz. Check your answers after your first attempt and try again to improve your score. The highest score will be recorded.

When you have completed the quiz you will have the rest of the period to work in your project teams.

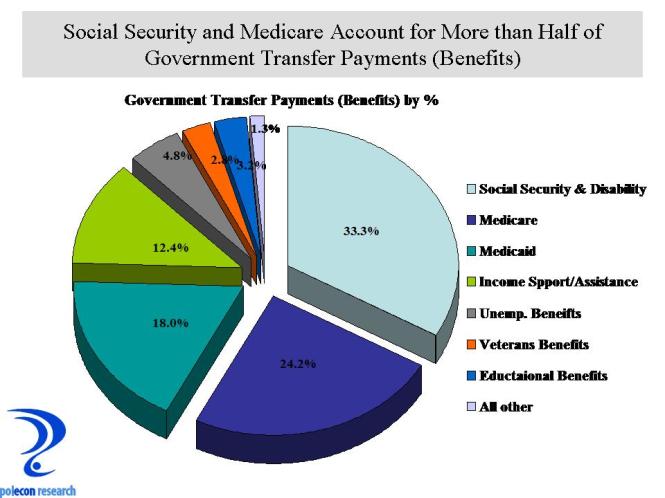

Objective: Students will learn about Fiscal Policy and how it can impact the economy by watching two videos and completing a worksheet. Students will work in their project teams.

Keynesian economics theory states that governments can influence economic productivity levels by increasing or decreasing tax levels and public spending.

Objective: Students demonstrate what they know about taxes, consumer spending and economic growth by taking Quiz 6C. Students will work in their Project Teams

You will have two attempts to take this quiz. Check your answers after your first attempt and try again to improve your score. The highest score will be recorded.

When you have completed the quiz you will have the rest of the period to work in your project teams.

Objective: Students will discuss the homework reading assignment LAP EC-009 Boom or Bust. Each team will discuss the Business Cycle Fact Sheet and decide if the statements are true or false. Teams will work on their projects.

http://www.moneycrashers.com/leading-lagging-economic-indicators/

http://www.investopedia.com/video/play/business-cycle/

Work in your teams to answer the questions on Business Cycle Worksheet

http://www.socialstudieshelp.com/eco_business_cycle.htm

Objective: Students will demonstrate what they know about Consumer Spending and Unemployment by taking Quiz 6B

You will have two attempts to take this quiz. Review your answers after the first attempt and take it again to improve your score. The highest score will be recorded.

When you have completed both attempts you can use the rest of the period to work on your project with your team.

Objective: Students will discuss the readings on Interest Rates and will work with their teams to answer the questions on the Interest rate Worksheet.

Suppose we buy a 1 year bond for face value that pays 6% at the end of the year. We pay $100 at the beginning of the year and get $106 at the end of the year. Thus the bond pays an interest rate of 6%. This 6% is the nominal interest rate, as we have not accounted for inflation. Whenever people speak of the interest rate they’re talking about the nominal interest rate, unless they state otherwise.

Now suppose the inflation rate is 3% for that year. We can buy a basket of goods today and it will cost $100, or we can buy that basket next year and it will cost $103. If we buy the bond with a 6% nominal interest rate for $100, sell it after a year and get $106, buy a basket of goods for $103, we will have $3 left over. So after factoring in inflation, our $100 bond will earn us $3 in income; a real interest rate of 3%. The relationship between the nominal interest rate, inflation, and the real interest rate is described by the Fisher Equation:

Work with your teammates to complete Nominal Interest vs. Real Interest Rate Worksheet

Objective: Students will discuss the readings on Unemployment with a partner and share what they discuss with the class. Students will work in their project teams.